Source: Bloomberg

These growth figures are backed up by investor interest. Over 80% of investors3 want to have responsible investing options within their portfolio and as many as 75%4 want their advisor to discuss sustainable investments with them. This isn’t just driven by a heartfelt desire to improve the world: 77% of investors believe that companies with good environmental, social and governance (ESG) practices make for better long-term investments.

So, what exactly are the advantages of sustainable investments, and what types of sustainable fixed income options are available to Canadian investors?

Benefits of investing sustainably

Apart from being able to invest in a way that aligns with your values, there are other considerable advantages to investing responsibly.

Reduce risks: Investigating a company’s ESG performance, as well as its financial balance sheet, can help mitigate investor risks. When BP’s Deepwater Horizon oil rig5 exploded in 2010, it caused the worst oil spill ever, brought about an environmental disaster and saw the company’s share price drop by more than 50%6 in just over two months.

The company had committed hundreds of health and safety violations in the past, and its Texas City refinery had blown up five years earlier. If investors had researched BP’s ESG performance before the disaster, they would have discovered the company’s poor safety record and possibly avoided buying its stock. As a result, they would have avoided the subsequent loss in share value.

Improve financial performance: Sustainable investments typically outperform their traditional counterparts. Research from the Responsible Investing Association7 found that 63% of responsible investing assets outperform their benchmark, and that 67% deliver better returns than the average.

Help bring about positive change: Sustainable investing provides funding to actively support projects that improve the world. This could be by promoting inclusivity and diversity, reducing poverty or combating global warming. Wealth management companies are also able to improve a company’s ESG performance through direct engagement.

Types of sustainable fixed income investments

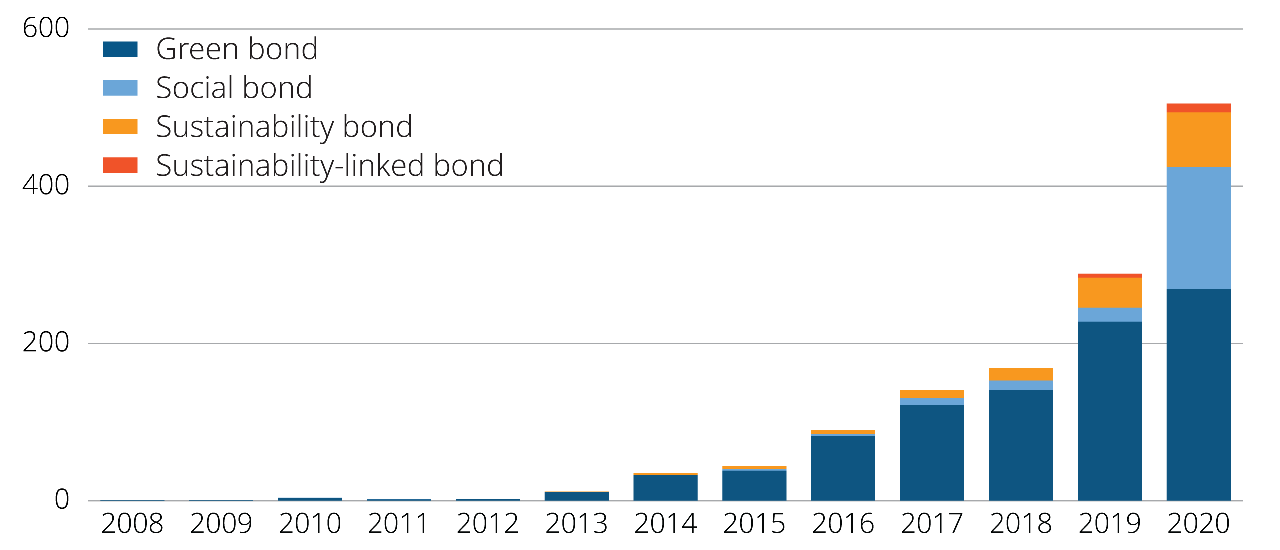

There are several types of sustainable bonds, which can be found in sustainable mutual funds and ETFs. These include:

Green bonds which fund projects that have a positive environmental impact (for example, the development of solar power).

Social bonds finance projects that bring about positive social outcomes (such as investing in social housing for low-income families).

Sustainable bonds represent a combination of the previous two, designed to fund projects that promote environmental and social sustainability.

Sustainability-linked bonds have performance goals that must be met, otherwise the issuers are penalized, usually in the form of an increased interest payment.

There are also labelled and non-labelled bonds. For example, a labelled green bond would raise money specifically for a project with direct, positive environmental impact, such as bringing electric transportation to a city. A non-labelled green bond is one that is not specifically labelled green, but is issued by an environmentally friendly company, such as a wind power turbine manufacturer.

Introducing the Mackenzie Global Sustainable Bond ETF (MGSB)

While there has been significant growth in the number of sustainable equity ETFs available in Canada (those containing company shares), there are few sustainable fixed income products (those that deliver income from bonds). As part of our commitment to providing Canadian investors with more investing options, we have launched the Mackenzie Global Sustainable Bond ETF.

This ETF was developed to provide investors with a fund that can form the backbone of a sustainable portfolio. It allows investors access to the four main types of sustainable debt (green bonds, social bonds, sustainable bonds and sustainability-linked bonds), from best-in-class sustainable companies that exhibit strong ESG characteristics.

The fund is designed to deliver a number of benefits to investors’ portfolios:

- It seeks to provide a steady flow of income, plus the potential for moderate capital growth.

- It contains sustainable and responsible issuers selected using a proprietary method of analyzing over 2,900 environmental, social and governance performance data points.

- It provides diversification through a broad selection of global sustainable corporate credit and sovereign debt, combining ESG-labelled debt with issuers who exhibit strong ESG characteristics.

- With credit ratings that are typically investment grade, these assets are in the low-risk category.

The assets in this fund are also found within the fixed income sleeve of the Mackenzie Global Sustainability and Impact Balanced Fund.

This ETF is managed by the Mackenzie Fixed Income Team, which was an early adopter of sustainable investing, and uses a proven proprietary process that integrates ESG factors into its investment selection.

How to fit sustainable fixed income into your portfolios

To find out more about the Mackenzie Global Sustainable Bond ETF and how it could complement your portfolios, for advisors, speak with your Mackenzie sales team; for investors, talk to your financial advisor.

_____________________________

1RIA, November 26, 2020

2 Morningstar, January, 28, 2021

3 RIA, December 31, 2019

4 The Globe and Mail, June17, 2021

5 Britannica, Deepwater Horizon Oil Spill, 2010

6 Market Realist, September 10, 2014

7RIA, December 31, 2019