Last year was tough for the markets: there was a tense and unpredictable geopolitical environment, supply chain issues, higher than expected inflation (with aggressive responses from various central banks), and major global equity and bond markets posted negative returns.

Despite all of this, the exchange-traded fund (ETF) industry once again showed its resilience. Overall, 2022 was the second-best year in history in terms of net asset inflows into ETFs, with US$867 billion.1 In Canada, the ETF industry had its third-best year ever, with net asset inflows of C$35 billion. There are now over 1,300 ETFs available in Canada, offered by 42 providers.2

The growth of ETFs

ETFs have been around for over 30 years, but their popularity has increased a lot over the past decade. ETF assets in Canada now represent almost 14% of investment fund assets, compared to just over 2% as recently as 15 years ago.3 This rise in popularity has often been due to their performance, low cost and media coverage.

It’s important to remember, however, that ETFs are an investment tool, not a strategy. In other words, ETFs don’t necessarily just replicate an index; they can also provide access to active or quantitative investment strategies.

When it comes to choosing an ETF, there are several key elements you need to consider as part of your due diligence process.

Why it’s important to choose an ETF that’s right for you

First, it’s important to remember that each investor is unique, with their own personal situation, objectives, risk tolerance and investment horizon.

It’s important to consider your situation and objectives carefully when looking at a strategic and tactical asset allocation. You then need to think about how the ETFs will fit into your portfolio; it’s important to determine which kinds of ETFs are best suited to the goals of the portfolio and your personal situation.

Steps to choosing an ETF

When you’re first considering how to choose an ETF, your due diligence process should begin with general education about ETFs; how they work and the myths that are attached to them. Find out more about common ETF myths, such as those regarding their liquidity levels, suitability for individual investors and risk levels.

The next step to choosing an ETF is to understand the investment strategy behind it. Let’s take a look at the different elements you should consider.

What exposure will an index get you?

The name of the ETF usually gives a good indication of the kind of assets the index contains; for example, the Mackenzie Canadian Large Cap Equity Index ETF (QCE) holds only large Canadian companies. However, it’s also wise to read the methodology of the index in detail, so that you know exactly which market segment is being replicated.

Who is the ETF’s index provider?

When choosing an index ETF, it’s important to know that several providers offer relatively similar indices that represent the same market segment (the four largest index providers for ETFs in Canada are: Standard & Poor’s (S&P), MSCI, Bloomberg Barclays and Solactive). It’s also important to understand how each index provider makes up its index; the methodologies can vary considerably.

Each index provider will have different rules for constructing and maintaining the index. These can include:

- Inclusion and exclusion criteria for companies.

- Rebalancing frequency and timing.

- Buffer zones.

- Methods of adjusting market capitalization to outstanding units.

- Management of cash received and payment of distributions.

- Tax regime considered for calculating returns.

- Currency hedging schedule.

All of these factors can lead to differences between the ways that two indices replicate the same market.

Does the ETF directly hold the underlying assets?

When choosing an ETF, the country where the ETF is held, as well as the way the underlying assets are held (directly, indirectly, indirectly via a foreign ETF, etc.) can have a significant impact on net returns for Canadian investors. Find out more about ETFs made for Canadians by Canadians.

Is the index easy to replicate?

You can’t invest directly in an index; it’s just a representation of a segment of the market. In order to gain exposure to this index, you’ll need to buy either an ETF or mutual fund, whose investment objective is to replicate it.

To copy the behaviour and performance of the index as closely as possible, the ETF has to use the index provider’s construction and maintenance rules, while taking into account the issues related to transaction costs.

Therefore, an ETF may not hold certain companies that are included in the index, because the cost of including them would be greater than the value they bring, just to fully replicate the index. This can lead to a difference in the behaviour between the ETF and the index (called the tracking error), and a difference in performance (the tracking difference).

It’s important to realize that, when it comes to index replication, the investment objective of the ETF is to replicate the benchmark index, net of expenses, as closely as is possible.

Who is the ETF's back-end provider?

With 42 ETF providers in Canada, it’s also important to get to know the ETF provider’s habits, competitiveness and involvement in the ETF community. You’ll also want to discover how much support, information and education it makes available to investors.

What is the total cost of owning the ETF?

When looking at how to choose an ETF, investors often focus on the ETF’s management fee. While the management fee is a key cost attached to the ETF, it’s not the only one. Other costs can influence the final value of the investment, including:

- The bid-ask spread.

- Transaction costs.

- Tracking error.

- Potential tax impact.

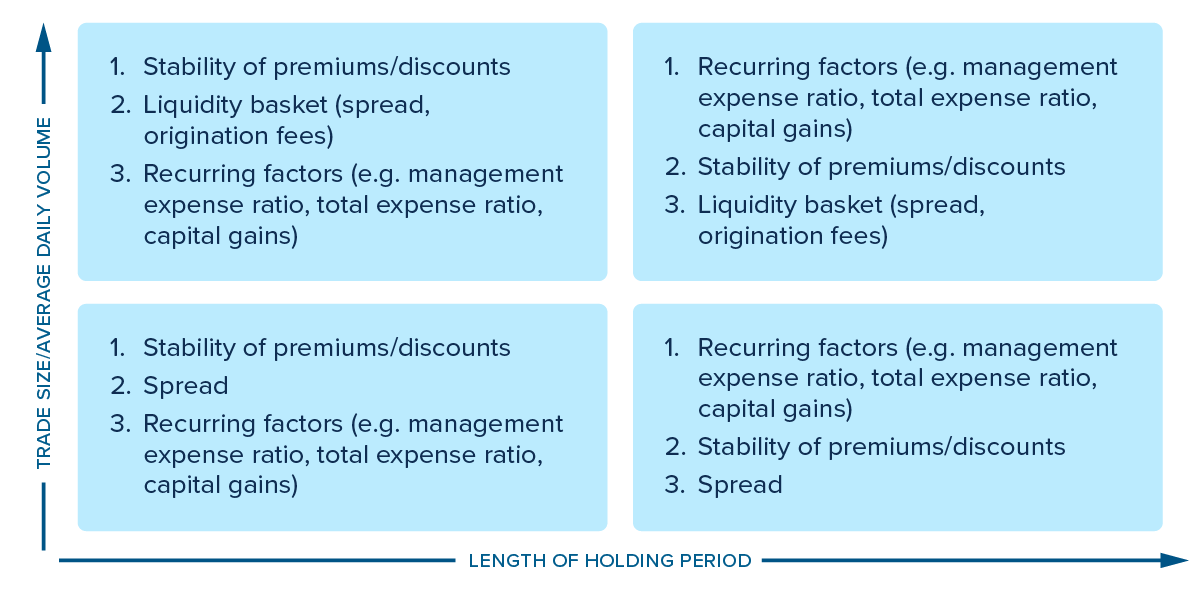

Management fees are therefore just one element to be considered when it comes to estimating your total costs incurred. Below is a chart that highlights the relative importance of different costs depending on the size of your investment and the length of time you intend to hold the ETF:

Length of holding period

More advice when choosing an ETF

Investors should contact their advisors to discuss the right types of ETFs to fit into their portfolios.

Advisors, find out more about how Mackenzie’s ETFs can complement your clients’ portfolios by contacting your Mackenzie sales team.

Sources:

1 Financial Times: ETF industry storms through 2022’s headwinds.

2 National Bank Financial Markets Annual report: December 31, 2022.

3 National Bank: Canadian ETF flows.

Commissions, management fees, brokerage fees and expenses all may be associated with Exchange Traded Funds. Please read the prospectus before investing. Exchange Traded Funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the prospectus before investing.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This article may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of April 21, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise. This should not be construed to be legal or tax advice, as each client’s situation is different. Please consult your own legal and tax advisor.